I think the gas stations are using tote boards for their prices. Unlike Jerry Lewis, they aren’t raising money to find a cure for Muscular Dystrophy.

I have hypothesized for years that gas companies keep the price at their “normal” level going into a long holiday weekend (Memorial Day, for instance); then jack up the price after you’ve left on a holiday trip, as if to say Go ahead, add a vacation onto the long weekend, we’ll get you when you come home! And we’ll get you the rest of the summer, as well! Vacay away!

Nancy and I were going to Costco, with a stop for lunch on the way. She needed gas in her car; we were going to fill it at Costco because it’s generally several cents less per gallon. As we drove past QuikTrip, I noted that their price had jumped to $4.199 over the past day or two. In the hour or so of our excursion, I was startled to see that QuikTrip had made another jump to $4.399 per gallon!!

An interesting observation was expressed in “The Climate Forward”:

The war in Ukraine has been good for oil companies.

Look no further than Shell’s first quarter earnings. It made record profits in the first three months of the year: $9.1 billion, nearly three times what it made in the first quarter of 2021.

Shell, the world’s largest private oil trader, took advantage of high global energy prices and market volatility, my colleague Stanley Reed explained. The company’s chief executive, Ben van Beurden, made a note of the Russian invasion of Ukraine. He said it had shown “that secure, reliable and affordable energy simply cannot be taken for granted.”

The rest of us are paying for those profits in at least two ways. Gas prices are way up, which means the price of everything else that relies on gas to get from point A to point B, is way up — including food. I’m feeling the pinch at the grocery store.

Inflation has changed our shopping and buying behavior, such as planning a trip around our need for gas. I worked at a gas station when I was in high school. It was what was called “a full-service station”: we pumped the gas in your car; we washed the windows; we checked the oil; we put air in the tires; and if there was a pretty girl in the car, we washed the windows again! The price of gas for all this service? – it typically hovered between $0.199 and $0.259 per gallon. A year or two later, we had gas shortages, and the price skyrocketed, with increases in some cases of 50% . . . and that was if you could stay in line long enough to get gas before the station ran out!

According to the US Inflation Calculator, if we converted that $0.199 into 2022 dollars, the price of a gallon of gas would be approximately $1.40. My hourly pay at the time was $1.50; today, that would equate to $10.49. During my time pumping gas, Shell was #15 on the Fortune 500 list, with profits of $244.5 million for the year; as noted above, their first quarter profits – the first three months of 2022 – were $9.1 billion. In case you wondered, the inflation adjusted profit for Shell would be $1.585 billion for the year, not $9.1 billion for the quarter.

We haven’t seen general market economy inflation like this since the early 80s when Reagan was president. Numerous studies have documented the fact that the average “middle-class” worker’s pay has not kept pace with inflation since then. Look around: how many of you and your friends have both spouses working, some more than one job, to maintain a middle-class lifestyle? It has become increasingly difficult to keep up, unless. . ..

The Economic Policy Institute published an analysis in 2019 of executive compensation; the title tells the story: “CEO compensation has grown 940% since 1978 – Typical worker compensation has risen only 12% during that time.” The ratio of executive compensation to worker pay provides interesting insight into the trend as it tends to neutralize the impact of inflation. The EPI analysis noted: “CEO-to-worker compensation ratio was 20-to-1 in 1965. It peaked at 368-to-1 in 2000. In 2018 the ratio was 278-to-1, slightly down from 281-to-1 in 2017—but still far higher than at any point in the 1960s, 1970s, 1980s, or 1990s.” About the time I quit pumping gas, the ratio was 22.2-to-1.

Have you bought beef lately? Oh my God! I have something of a personal connection to meat. When I was consulting full-time about 40 years ago, we had a project for a fairly large meat processor. They were somewhat unique in that they processed sheep in addition to cows and pigs. (I learned that a Judas Sheep was the one that led the rest of the sheep up the chute to slaughter; as a reward, he was sent back to the pen to live another day and lead the next group that came in. What a life! I can imagine a conversation while the sheep are grazing in some bucolic meadow in the afterlife: “What did you do for a living?” “I was a leader – a Judas Sheep, who led many of you to this promised land.”)

The first thing we did on that project was tour the plant. We began in the pens, walked up the chute and followed the last cow into the kill room, and continued through the final processing point. As we were stopped at one station, I noticed a large cauldron of indistinguishable stuff. Looking at it I asked what they did with the waste. Their wide-eyed answer was that that stuff was going to be hot dogs. While it might make you reconsider what you’re putting on your grill this weekend, I will say the hot dogs they served in the plant cafeteria were fresh and tasty!

Thinking of hot dogs, we need to serve up more beer and fewer hot dogs at our summer cookouts: the price of hot dogs has risen 10% over a year ago, but beer is up only 4%. Or you might want to begin boiling water and drawing butter: one grocery chain CEO reported seeing the price of lobsters starting to come down.

Beef prices present an interesting illustration of the market dynamics that are fueling some of the inflation. An analysis of the beef industry illustrated a lack of competitive forces:

The beef industry is one of the most concentrated food sectors: Just four companies are in charge of about 85 percent of the processing and packaging of beef.

But it hasn’t always been this way. About 100 years ago, the industry was controlled by five companies, and the Justice Department stepped in to break up their power — spurring decades of competition. By 1980, the top four businesses controlled only 36 percent of cattle slaughters in the U.S. Yet a flurry of deals throughout the 1980s shifted the industry’s structure to where it is today.

During my early teens, my family would travel to Muldrow, Oklahoma. Big Jim would have his annual antique sale in the large barn on his farm. Before the sale, Big Jim would let me practice driving in the fields near the house and barn. Even more memorable, though, was the stop we made on the way to Muldrow.

My mom had somehow connected with a woman who owned a motel in Springdale, Arkansas. Mom would sell some special antique glassware that the woman collected while we were there. The highlight, though, was dinner at the AQ Chicken House. They used their own special batter on not only the chicken but also the fries. The eatin’ just didn’t get much better than battered French fries and fried chicken.

It also helped that the chicken, like those hot dogs at the plant, was fresh. Everyone in the area who had enough space for a chicken coop was raising chickens. If you got behind one of the trucks taking chickens to the processing plant, chicken feathers would be flying at you like you were in a blizzard!

Tyson Foods was the reason for all those chickens. Tyson has been headquartered in Springdale since the company’s founding in 1935. Tyson is big business, 79th on the Fortune 500 in 2020. It has diversified and grown through acquisition. According to Wikipedia, “Tyson produces about one-fifth of the beef, chicken, and pork sold in the United States.[10] . . . The company makes a wide variety of animal-based, prepared foods and plant-based products at its 123 food processing plants. . . . Its plants slaughter approximately 155,000 cattle, 461,000 pigs, and 45,000,000 chickens every week.[11]”

Tyson is best known for its chicken, and at a slaughter rate of 45 million chickens per week, there’s good reason. But 155,000 cattle per week places it in the top four of beef producers who, as noted previously, control about 85% of the market.

We readily turn to economists to help explain inflation. Let’s see, did they tell us that the Fed’s recent rate increase would cause inflation or curb it? According to “Buttonwood’s Notebook” in The Economist, “Harry Truman famously asked to be sent a one-armed economist, having tired of exponents of the dismal science proclaiming ‘On the one hand, this’ and ‘On the other hand, that.’ Economists are more inclined to stock [sic] their neck out these days (being a celebrity pundit is a good living) but I am not sure that has reduced the confusion.”

I thought a government economist might help explain the numbers behind inflation.

There are plenty of explanations, and plenty of fingers being pointed “on the other hands,” to explain why the costs of all the stuff we want are rising. Of course, the granddaddy is Covid: worker shortages; illness; supply chain issues; and so on. And then the spinoffs like the “great resignation” – once many of the employees weren’t working, they realized how badly work sucked and they wouldn’t return when things began picking back up.

The hospitality industry has been hit particularly hard. The Corner Café is an example of the problem now being faced by the worker shortage. They have always been one of those favorites where you waited for breakfast, lunch, and dinner. The wait-times have grown because they keep an entire section of their dining room closed due to lack of help.

When we go to The Corner Café for breakfast, unless I order their excellent biscuits and gravy, I ask for a toasted English muffin instead of their standard side of toast. A little orange marmalade on a toasted English muffin . . . um, um, um! Granny uses orange marmalade for a quick explanation of inflation.

Granny must be younger than I. When he was in high school, my son and a couple of his friends were complaining about their pay at their respective part-time jobs. I shared with them that my first paycheck-job (as opposed to mowing lawns, etc.) paid me 25-cents per hour, and I worked a half-hour a day – that’s 12-½ cents per day. Eyes wide and mouths open, they stopped complaining.

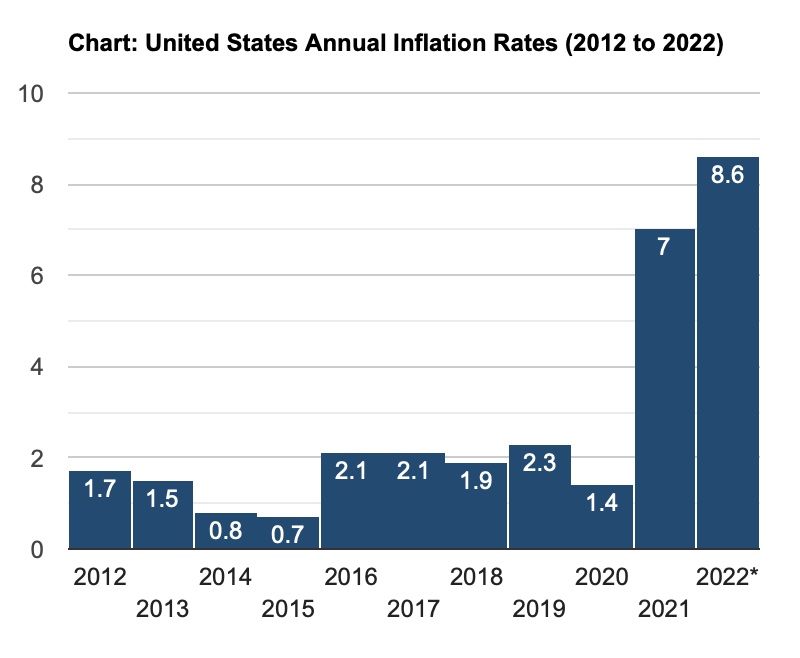

Inflation exists over time, and by design. The U.S. Federal Reserve Bank strives to maintain a long-term average of 2% inflation because it “is most consistent with the Federal Reserve’s mandate for maximum employment and price stability.” But the 2% goal is a long-run average. The rate at any given time will fluctuate, as this recent headline describes our current situation: U.S. Inflation Highest Since 1981 as CPI Hits 8.5% in March.

As you can see from the graph, the inflation rate was near that 2% mark for nine years before inflation began to kick in after the worst part of the pandemic, supply chain interruptions, rising wages to entice workers back into lower-wage positions, and so on.

Despite the graphs, and the math and science of economics, it really is little more than an attempt to quantify human social behavior. The simplicity of that statement obscures the complexity of an economic model that assumes all of us behave in a rational manner (I don’t know about you, but I have some fine examples of irrational behavior in my past!).

The bottom line is to ask yourself if you are experiencing the quality of life you want. If you’re not, make changes. And as any economist with two arms would add, “on the other hand,” if life is good, enjoy the ride.

Enjoy a live performance of “Working Overtime.” Some nice guitar work, but you can skip forward to about 2:45 to miss the overly long introduction – what can I say? – it was a concert.

Love the stories. Keep ‘them coming.

LikeLike